Summary Inflation Report Consumer Price Index (2018=100)

I. INFLATION RATE (IR)

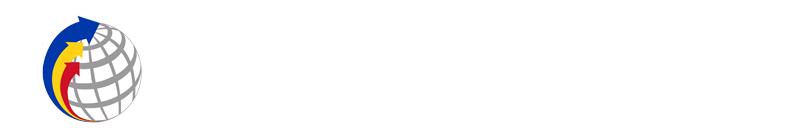

Inflation in Ifugao increased to 3.1 percent in December 2024 from 1.4 percent in

November 2024. In addition, December 2024 inflation was lower by 3.7 percentage points from 6.8 percent in December 2023 and 1.7 percentage points higher from 1.4 percent in

November 2024. (Table 1). The provincial average inflation for the year 2024 was 4.2 percent.

Table 1. Year-on-Year Inflation Rates, All ltems Ifugao ln percent

(2018=100)

Area | December 2023 | November 2024 | December 2024 |

CAR | 2.8 | 3.3 | 3.3 |

IFUGAO | 6.8 | 1.4 | 3.1 |

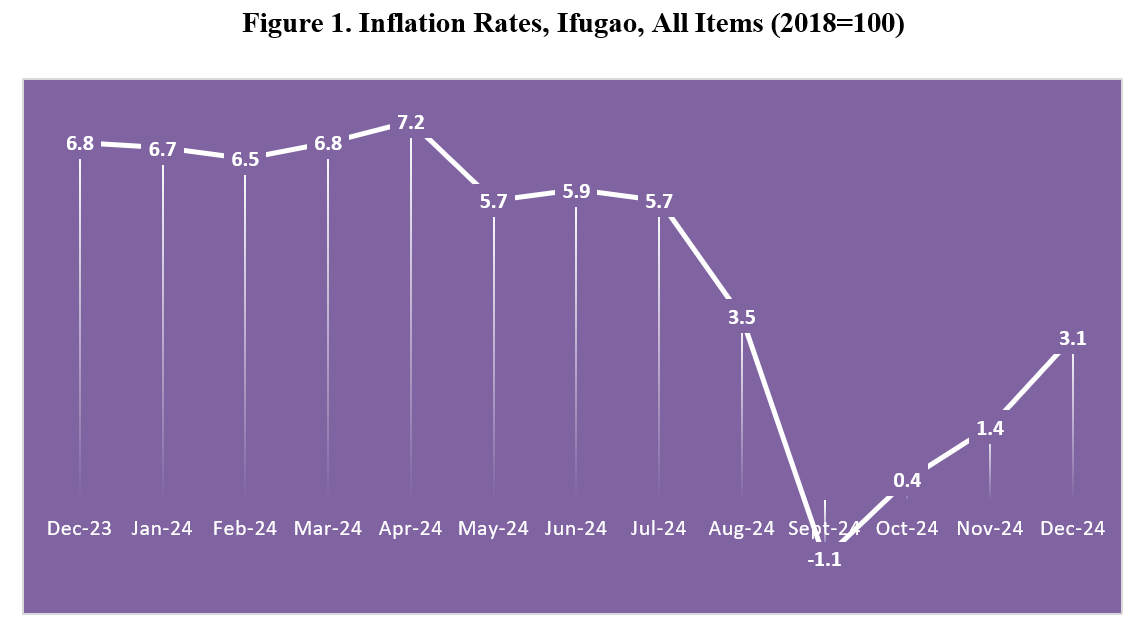

Figure 2. Year-on-Year Inflation Rates by Commodity Group: Ifugao (2018 = 100) (In Percent)

In terms of inflation rates among commodity groups, Restaurants and Accommodation Services experienced the highest share and increase at 14.4 percent.

In addition, contributing to the uptrend in the overall inflation during the period were the higher annual average growth in the indices of the following commodity groups:

- Food and Non-Alcoholic Beverages, 7.3;

- Recreation, Sport and Culture, 2.6;

- Furnishings, Household Equipment and Routine Household Maintenance, 2.4;

- Clothing and Footwear, 1.5;

- Education Services, 1.4;

- Personal Care, and Miscellaneous Goods and Services, 1.2;

- Information and Communication, 0.9;

- Health, 0.6;

- Alcoholic Beverages and Tobacco, 0.5

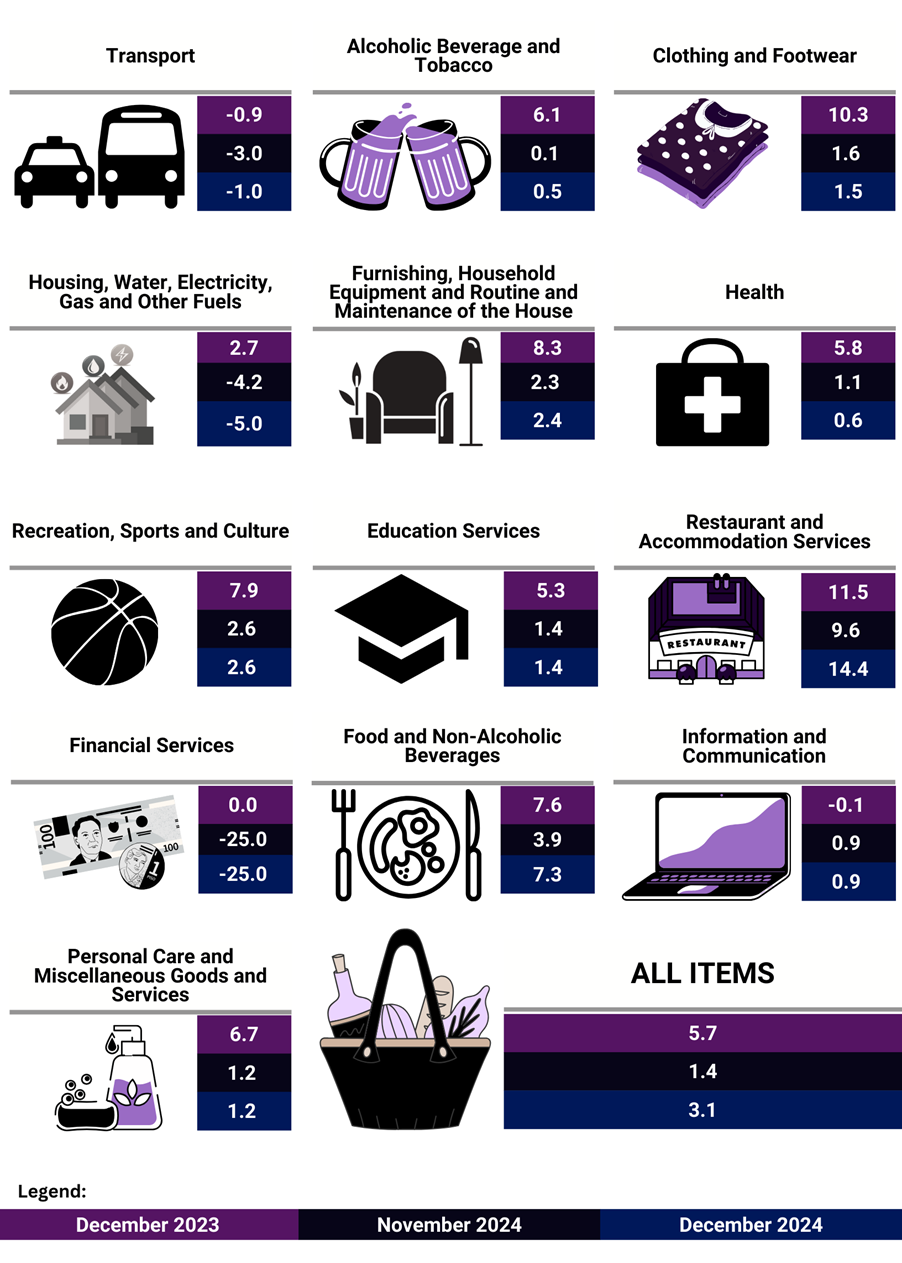

- CONSUMER PRICE INDEX (CPI)

The Survey of Retail Prices of Commodities, conducted by the Philippine Statistics Authority (PSA), has produced a Consumer Price Index (CPI) of 131.1 in Ifugao as of December 2024, with 2018 serving as the base year. This figure indicates that the overall cost of a typical basket of goods and services commonly purchased by a Filipino household in various municipalities of Ifugao remained stable during the reference month.

Table 2 illustrates that some commodity groups increased their Consumer Price Index from their year-on-year CPI except for Housing, Water, Electricity, Gas and Other Fuels, Transport and Financial Services. On month-on-month CPI, Information and Communication, Recreation, Sports and Culture, Education Services, Financial Services and Personal Care, Miscellaneous Goods and Services maintained their CPI.

Table 2. Consumer Price Index by Subgroup ,Month-on-Month and Year-on-Year Percent Changes

III. PURCHASING POWER OF PESO (PPP)

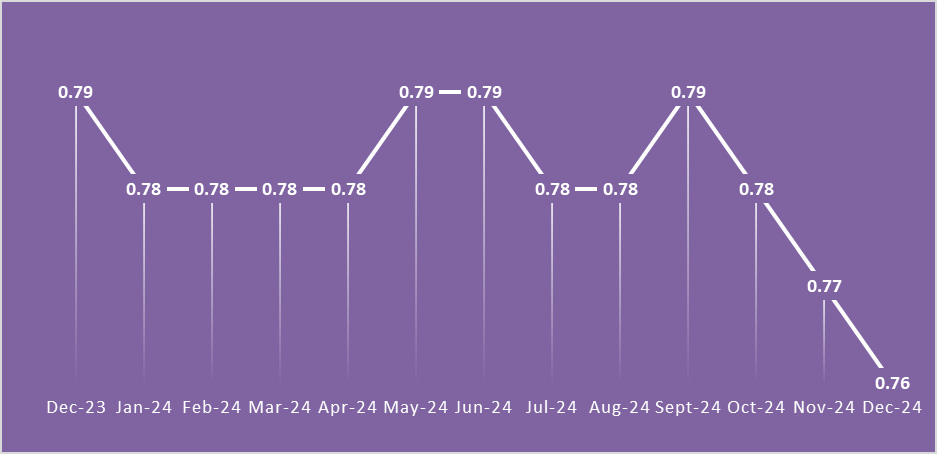

Figure 4. Monthly Purchasing Power of Peso in Ifugao (2018 = 100)

The Purchasing Power of the Peso (PPP) is intricately linked to the Inflation Rate, functioning inversely; as the Inflation Rate drops, the PPP increases. For instance, consider the value of one peso from 2018: by December2024, it is valued at 76 centavos, reflecting a decrease of three centavos from December 2023. Similarly, a hundred pesos from 2018 would translate to just

76 pesos by November 2024.

This decline in the purchasing power of the peso underscores the significant impact of inflation on consumers. When inflation is high, the value of money erodes, making it harder for individuals to maintain their usual standard of living. When inflation is low, purchasing power improves, making it easier for consumers to manage their expenses and stretch their budgets.

An increase in the purchasing power of the peso means that each peso can buy more goods and services than before, allowing consumers to get more value for their money.

TECHNICAL NOTES

Consumer Price Index (CPI)

The CPI is an indicator of the changes in the average retail prices of a fixed basket of goods and services that most people buy for their day-to-day consumption relative to a base year.

Uses of CPI

The CPI is most widely used to calculate inflation rate and the purchasing power of peso. It is a major statistical series used for economic analysis and as monitoring indicator of government economic policy. It is also used to adjust other economic series for price changes. For example, CPI components are used as deflators for most personal consumption expenditures (PCE) in the calculation in the Gross National Product (GNP). Another major importance of the CPI is its use as basis to adjust wages in labor management contracts as well as pensions and retirement benefits. Increases in wages through collective bargaining agreements used the CPI as one of their bases.

Computation of the CPI

The computation of the CPI involves consideration of the following important points:

Base Period.

The reference date or period is the benchmark or reference date or period at which the index is taken as equal to 100

Market Basket

A sample of the thousands of varieties of goods purchased for consumption and services availed by the households in the country was selected to represent the composite price behavior of all goods and services purchased by consumers.

Weighting System

The weighting pattern uses the expenditures on various consumer item purchased by households as proportion to total expenditure.

Formula

The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the

Laspeyre’s formula with a fixed base year period (2012) weights.

Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities.

Inflation Rate (IR)

The Inflation Rate is the rate of change or the year-on-year change of the CPI. Inflation is interpreted in terms of declining purchasing power of peso.

Headline Inflation

Headline inflation refers to the rate of change in CPI. It captures the changes in the cost of living based on the movements of prices of items in the basket of commodities and services consumed by the typical Filipino households.

Core Inflation

Core inflation measures the change in average consumer prices after excluding from the CPI certain items with volatile price movements. By stripping out the volatile components of the CPI, core inflation allows us to see the broad underlying trend in consumer prices. Core inflation is often used as an indicator of the long-term inflation trend and as indicator of future inflation. It is usually affected by the amount of money in the economy relative to production, or by monetary policy.

Purchasing Power of the Peso (PPP)

The purchasing power of the peso (PPP) shows how much peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

DELANO C. BOLISLIS, JR.

Chief Statistical Specialist

/JOT