Release Date :

Reference Number :

SR 2019-30

Employment in Accommodation and Food Service Establishments down by 10.6%

- Workers in the accommodation and food service (AFS) sector registered to 249,490 persons in 5,540 establishments in the country. This was a decrease of 10.6 percent from the employment of 279,048 personnel in 2016 from 5,971 businesses in the sector.

-

Paid employees remained dominant in the employment of AFS sectors with 99.6 percent share in 2017. This was a minimal improvement in terms of share to total employment from 99.4 percent in 2016, but a decrease by 28,964 paid workers in a year’s span.

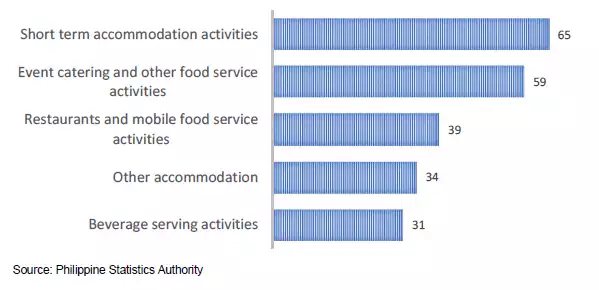

Figure 1. Average Employment per AFS Establishment by Sector, Philippines: 2017

- About 61.0 percent in the AFS sector were employed in restaurants and mobile food establishments with a total employment of 152,276 from 3,898 establishments in 2017. This was followed by the employment in the short-term accommodation activities with 84,679 workers from 1,306 businesses or 33.9 percent in the sector.

-

The rest of the employment in AFS were involved in beverage serving activities (3.1 percent), event catering and other food services (1.8 percent) and other accommodation services (0.1 percent).

-

Short term accommodation activities have most workers per establishment on the average with about 65 employees in 2017. Event catering and other food service followed with 59 employees per establishment. On the other hand, beverage serving activities have the least workers with 31 employees per establishment.

-

MIMAROPA had the highest average of employed per establishment with 60 workers, followed by CAR with 58 workers per establishment. AFS establishments in Caraga Region came third with 51 average workers per establishment. Businesses in ARMM recorded the lowest average employment with 28 workers per establishment.

Compensation of AFS workers at PHP44.1 billion

- AFS establishments had a total expense of PHP 247.3 billion in 2017. This indicated a decline of expenditures by 20.8 percent from PHP 312.3 billion in 2016. Compensation of workers shared 17.8 percent in the total expense while the rest were spent for other costs such as taxes, job contracts, goods, fees and other operation expenses.

-

ARMM had the highest proportion of compensation to total expenses of AFS establishments, with PHP 22.0 million compensation out of PHP 86.1 million total cost, with about a quarter of its total expenditures or 25.6 percent. Other regions with compensation share from total expense at par or higher than the national figure were MIMAROPA (21.9 percent), CAR (20.5 percent), Western Visayas (20.5 percent), National Capital Region (18.8 percent), CALABARZON (18.3 percent), and Central Visayas (17.8 percent).

-

The national average compensation per worker in the AFS industry was PHP 177,520 per year in 2017, or about PHP 14,793 per month. This was lower than the figure in 2016 of PHP 191,375 annual compensation, or PHP 15,948 monthly on the average.

-

AFS workers in NCR have the highest mean annual compensation of PHP 230,228 or a monthly average compensation of PHP 19,185. The lowest was in CARAGA with PHP 103,761 per year, or PHP 8,647 mean monthly compensation per worker.

-

Workers in short term accommodation activities have better compensation than other AFS activities, with PHP230,984 annually or PHP19,249 monthly. Workers in other accommodation activities had the lowest annual compensation of PHP90,207 or PHP 7,517 monthly.

Figure 2. Average Compensation (PHP) per Worker by AFS Sector, Philippines: 2017

AFS establishments income per expense at 1.36 in CAR

- Income generated from accommodation and food services reached PHP306.4 billion, down by 16.8 percent from PHP368.3 billion in 2016. About half of the total income (54.4 percent) was derived from restaurants and mobile food service activities while 41.7 percent was from short-term accommodation services.

-

AFS establishments in NCR contributed nearly half of the total income of the industry, sharing PHP151.5.8 billion to the national figure (49.6 percent). The rest of the country shared the other half of AFS income generated in 2017. CAR establishments derived PHP3.9 billion income or 1.3 percent of the total.

-

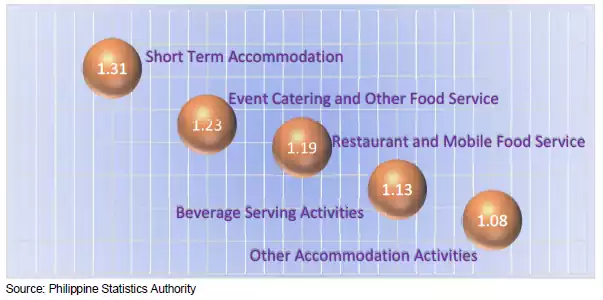

The income per expense of all AFS establishments registered at 1.24 in 2017. This means there is 24.0 percent revenue of these establishments net of all its expenses in the production and delivery of services. This was an improvement compared to the figure a year ago with 1.18 income per expense.

-

Short term accommodation activities produced 31.0 percent gain based on its income per expense of 1.31. Event catering and other food service activities resulted to an income per expense of 1.23. Other accommodation activities had the least returns with an income per expense ratio of 1.08.

-

Among regions, AFS businesses in Northern Mindanao, Eastern Visayas and NCR gained more than a quarter of its expenses, with 1.60, 1.35 and 1.27 income per ratio, respectively. Establishments in Central Luzon and Bicol Regions were at par with the income per expense at the national level. However, those in the Davao Region returned the least with only 9.0 percent of its expense, or a 1.09 income per expense for 2017.

Figure 3. Income per Expense of AFS Establishments by Sector, Philippines: 2017

Labor productivity in NCR reach PHP675 million per worker

- Value added of AFS establishments in 2017 hit PHP116.4 billion, a figure fell short by 13.9 percent from the previous year. Restaurant and mobile food service shared the largest fraction of value added with 51.5 percent or PHP59.9 billion while short term accommodation activities contributed 45.1 percent or PHP52.5 billion.

-

NCR establishments shared 47.9 percent of the total value added of AFS businesses in the country with PHP55.8 billion. This was followed by Central Visayas with PHP13.6 billion and CALABARZON with PHP10.4 billion.

-

The labor productivity, or value added per total employment, of the AFS industry was estimated at PHP466,579 in 2017. This however was a lower figure than a year ago, with labor productivity of PHP484,469.

-

Higher productivity was evident in the sectors short term accommodation, event catering and other food services, and restaurants and mobile food service activities. These sectors recorded labor productivity of about PHP400,000 or more annually. Meanwhile, beverage serving and other accommodation activities had value added over employment of below PHP250,000 for the year.

-

Establishments in Northern Mindanao, NCR and Central Visayas surpassed the national labor productivity for the year, with Central Luzon and Bicol Region following closely with above PHP400,000 annual labor productivity. AFS activities in SOCCSKSARGEN, ARMM, Zamboanga Peninsula, Davao Region and CAR barely passed the PHP300,000- mark of annual labor productivity in 2017.

Sales from E-Commerce in AFS industry still at PHP5.6 billlion

- Online sales of products and services in the AFS industry remained at PHP5.6 billion in 2017. Only activities in short term accommodation and restaurant and mobile food service reported gains from electronic transactions.

-

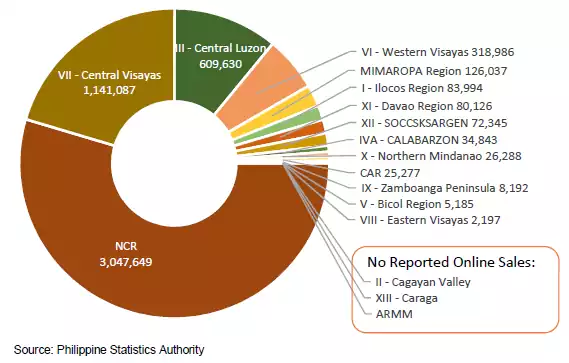

Short term accommodations shared PHP5.5 billion sales from e-commerce transactions in 2017, short of about PHP30.1 million of sales compared to that of previous year. Meanwhile, restaurants and mobile food services contributed PHP151.9 million, an improvement of 27.4 percent from electronic sales in 2016.

-

AFS businesses in NCR reported the biggest sales through online transactions, with PHP3.4 billion in 2017. This was 60.1 percent of the total e-commerce sales at the national level. Central Visayas, Central Luzon and Western Visayas regions boosted their sales through electronic means with PHP993.4 million, PHP419.7 million and PHP327.6 million, respectively.

Figure 4. Sales from e-Commerce of AFS Establishments by Region, Philippines: 2017

- Establishments in Cagayan Valley and Eastern Visayas regions still gained minimal online sales, both with under PHP10.0 million worth of AFS products and services for the year. Northern Mindanao, Caraga and ARMM did not report any online transaction sales as in the previous year.