CONSUMER PRICE INDEX

ABRA: September 2022

(2018=100)

PRICE SITUATION: Year-on-Year

The Consumer Price Index (CPI) for all income household in Abra for September 2022 is 117.1. This implies that a household in Abra needs 17.1 pesos to purchase the same basket of goods worth 100 pesos in 2018.

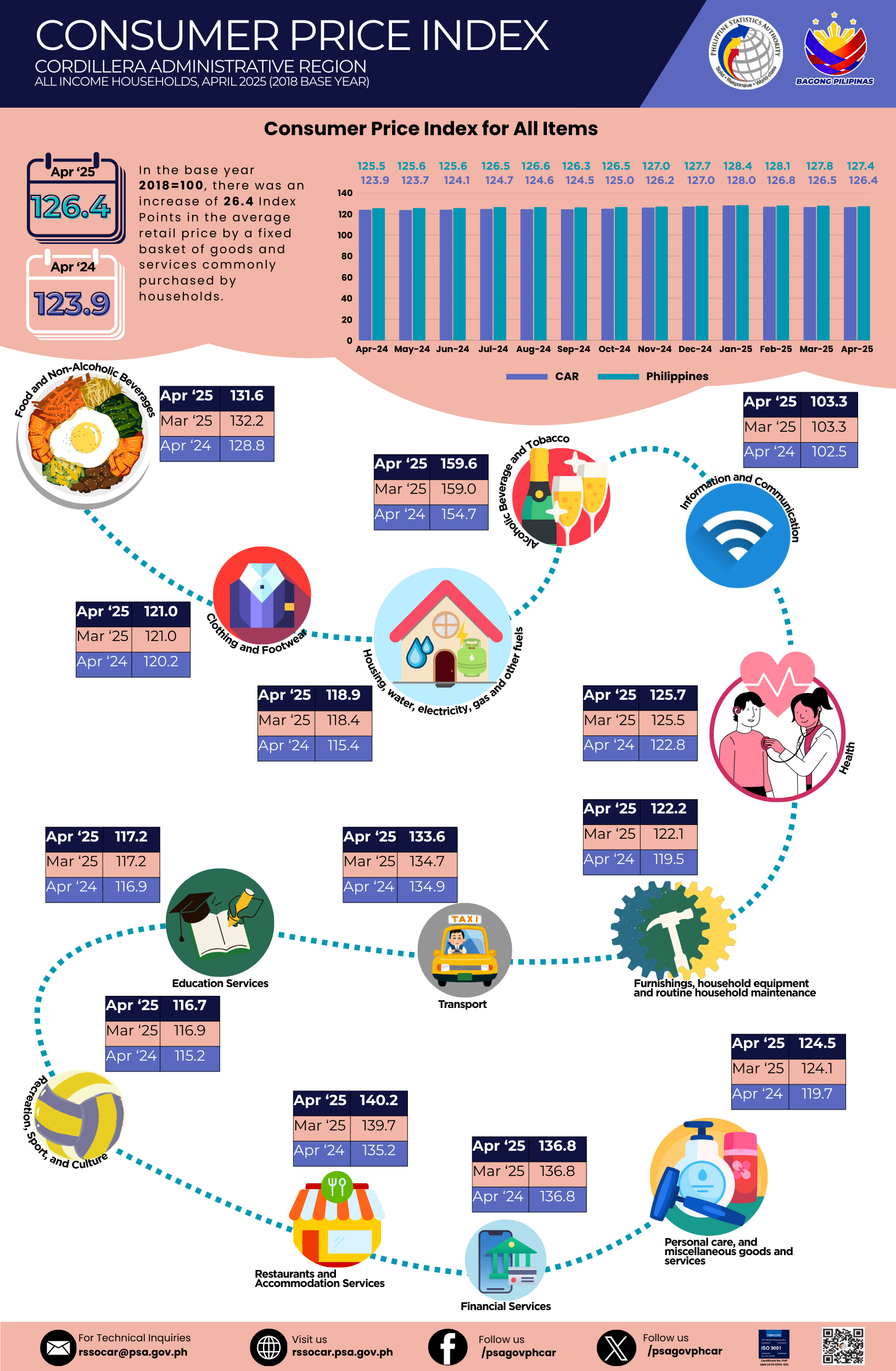

Table 1. Consumer Price Index by Commodity Group for All Income Households, Year-on-Year Percent Change in ABRA: August 2022 and September 2021 (2018 = 100)

This month’s CPI for all items is 7.3 higher than last years’s index. Changes in the prices of different commodities determine the fluctuations in the monthly CPI.

The higher index was due to the recorded price changes in the following: Transport at 20.1 percent, Housing, Water, Electricity, Gas and Other Fuels with 14.1 percent and Alcoholic Beverages and Tobacco with 6.1 percent

All other commodities groups increased in prices, except the Information and Communication, Education and Financial Services which posted a static percent change.

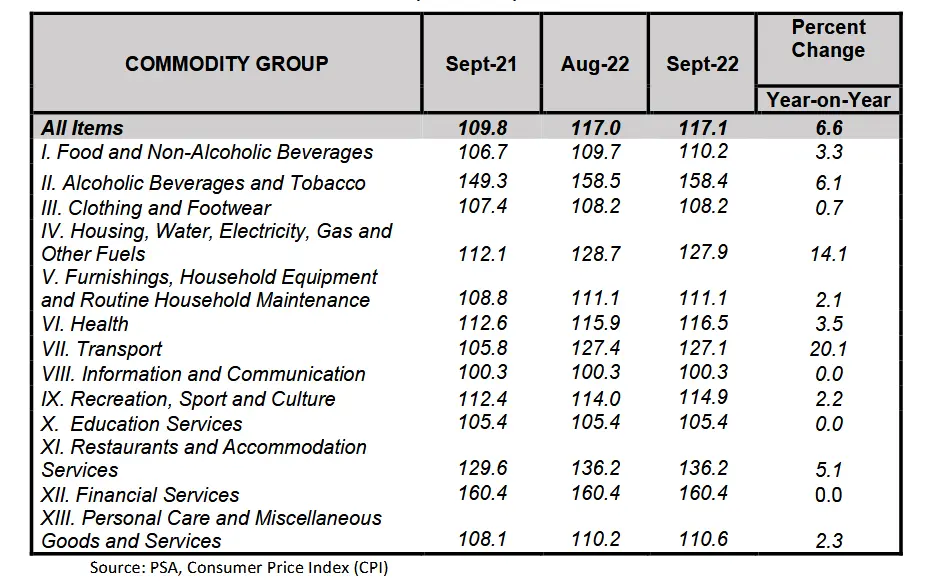

Figure 1. Consumer Price Index for All Income Households by Commodity Group,

ABRA: August 2022 and September 2022

(2018=100)

Inflation Rate (IR)

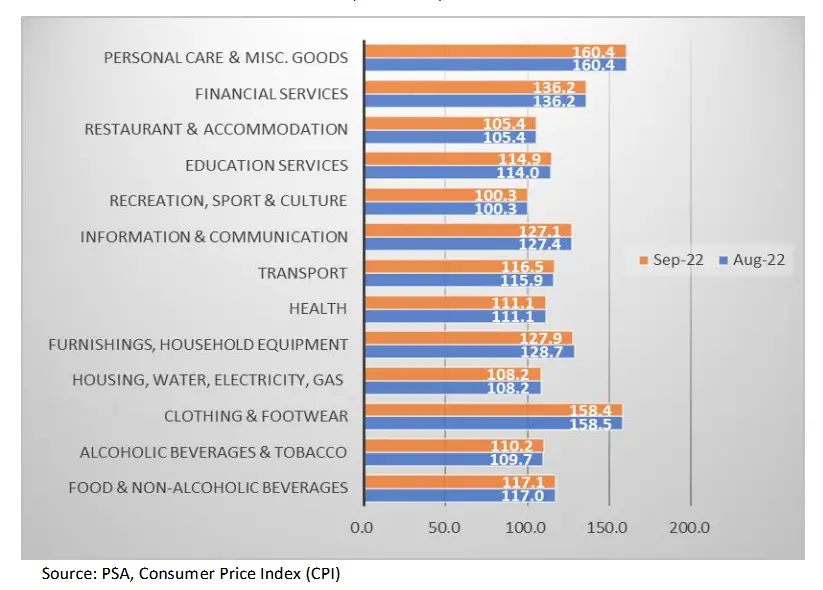

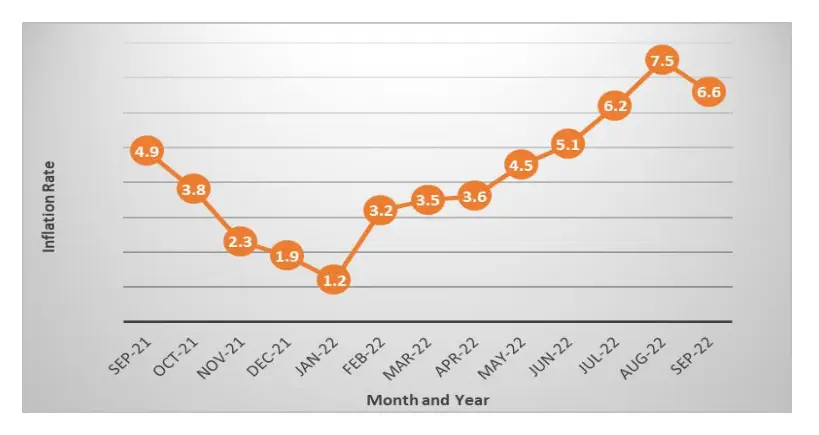

Figure 2 below shows a difference of 2.1 percent increase on year-on-year comparison between September 2021 with 4.9 and September 2022 with 6.6 inflation rates, and a 0.9 percent decrease compared to August 2022 with 7.5 inflation rate.

Figure 2. Year-on-Year Inflation Rate (IR) All Items (2018=100)

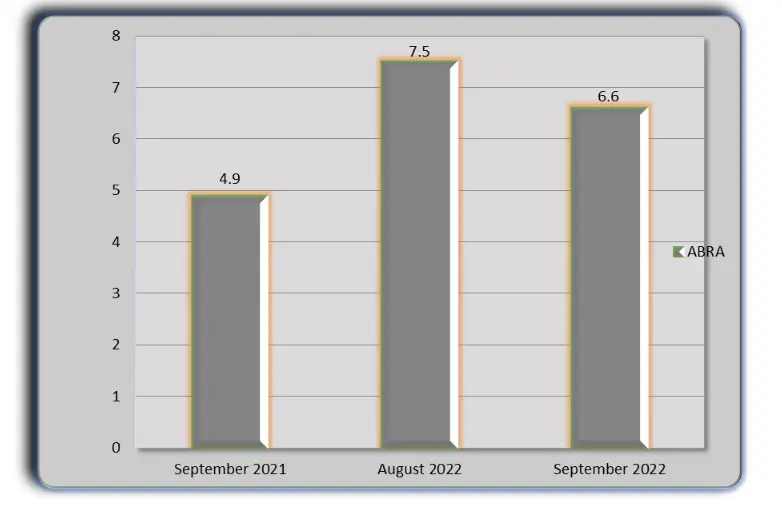

Figure 3. Inflation Rate (IR) by Month in Abra:

September 2021 to September 2022Figure 3 shows the trend of inflation rate in the province for the period

September 2021 to September 2022. Inflation rate posted the least in January 2022

with 1.2 percent while its highest inflation rate was observed in August 2022 with 7.5

percent.

Concepts and Definitions

Consumer Price Index (CPI)

The CPI is an indicator of the changes in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

Uses of CPI

The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as a monitoring indicator of government economic policy.

Computation of CPI

The computation of the CPI involves consideration of the following important points:

a. Base Period- The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100.

b. Market Basket- A sample of the thousands of varieties of goods purchased forconsumption and services availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

c. Weighting System- The weighting pattern uses the expenditures on various consumers’ items purchased by households as a proportion to total expenditure.

d. Formula-The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed based year period (2006) weights.

Inflation Rate is the rate of change of the CPI expressed in percent. Inflation is interpreted in terms of declining purchasing power of peso.

Headline Inflation refers to the rate of change in the CPI, a measure of the average standard “basket” of goods and services consumed by a typical family.

Purchasing Power of Peso shows how much the peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.