The Cordillera Administrative Region (CAR) is one of the 17 component regional economies comprising the Philippine economy. The region’s diverse range of industries and sectors contribute to the country's overall growth. To gain deeper insights into CAR's economic impact, this report presents the findings from the 2020 Annual Survey of Philippine Business and Industry (ASPBI) specifically focusing on the Real Estate Activities Section. The ASPBI serves as a comprehensive source of data, shedding light on the region's role and contributions in the real estate sector during the reference year of 2020.

Following the end of data collection, a thorough analysis was carried out to offer a clear and accurate portrayal of CAR's contributions to the Philippine real estate market. The final findings were generated using statistical approaches and data processing techniques, highlighting important performance metrics that demonstrate the region's economic relevance in this industry.

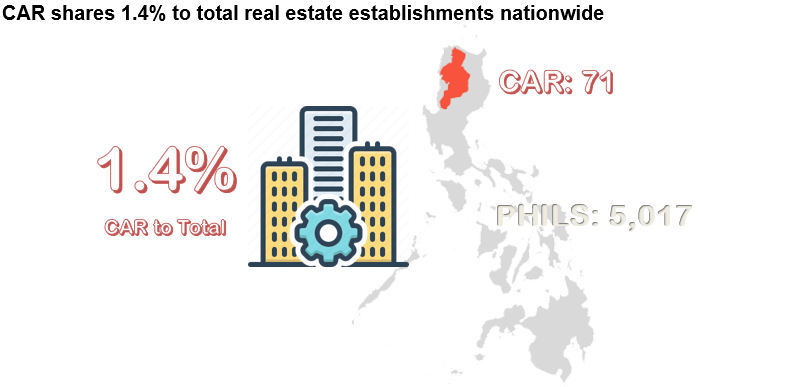

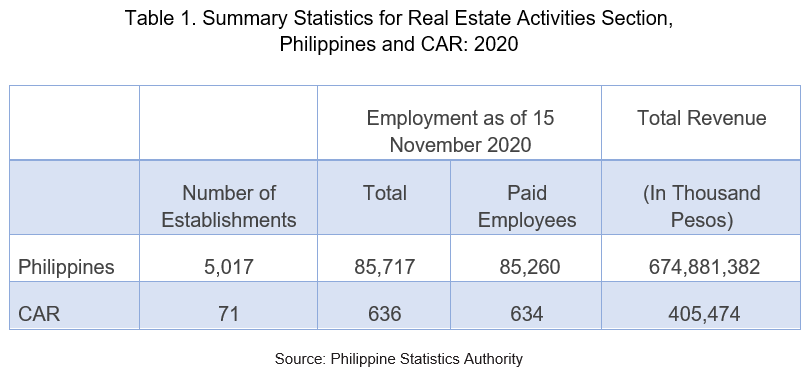

The Cordillera Administrative Region (CAR) consists of 71 establishments out of the 5,017 real estate establishments in the Philippines. As of November 15, 2020, there were 636 employees in CAR out of 85,717 in the Philippines. The total number of paid workers in CAR was 634, whereas the national total for paid employees in the Philippines was 85,260. CAR generated a total revenue of 405.5 million pesos out of the 674.9 billion pesos total revenue in the Philippines.

CAR ranked tenth for the number of establishments, eleventh for total employment and total paid employees, and thirteenth for total revenue in the real estate sector across all regions.

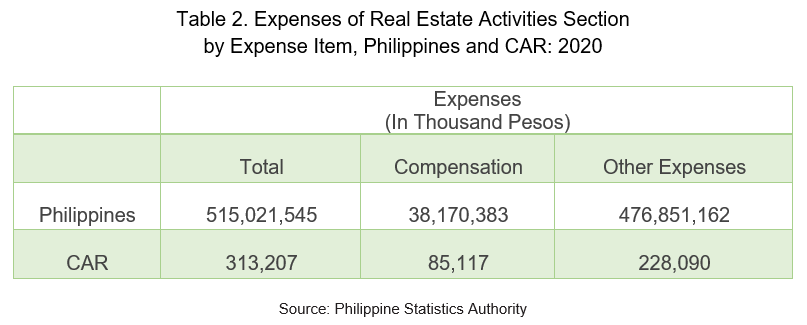

Establishments spend 313 million pesos in 2020

CAR recorded 313.2 million pesos in total expenses out of the 515.0 billion pesos total expenses reported by establishments involved in real estate activities in the Philippines. Additionally, the region accounted for 85.1 million pesos in compensation expenses out of the 38.2 billion total compensation by this sector; and 228.1 million pesos out of the total 476.9 billion pesos other expenses of the real estate establishments in the Philippines.

CAR ranks 11th in employment

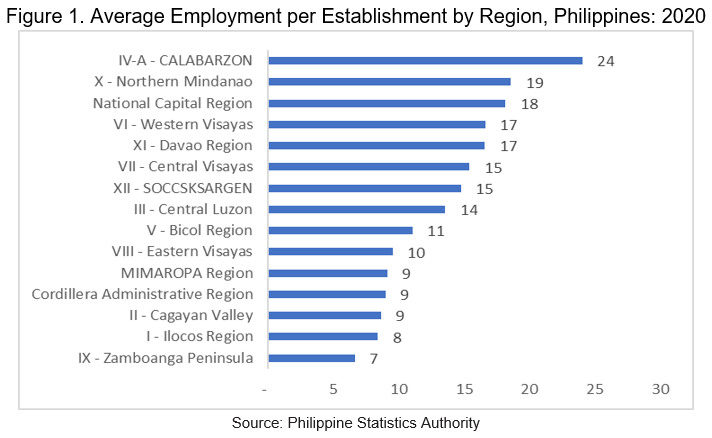

CAR had an average of nine (9) employed individuals per establishment and was ranked eleventh in the Philippines, along with MIMAROPA Region and Cagayan Valley.

CAR ranks 12th in average compensation

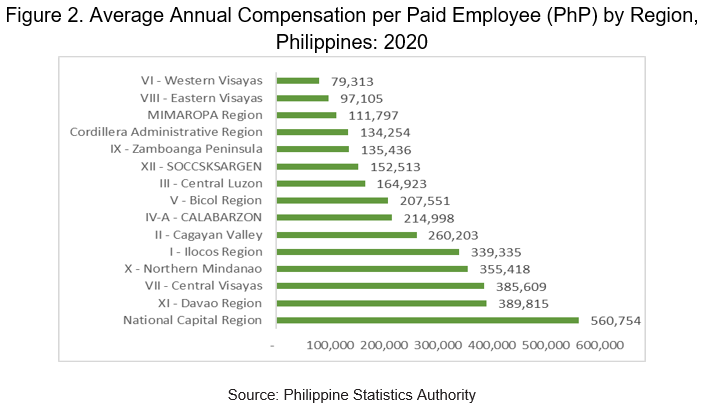

CAR establishments had PhP 134,254 average annual compensation per paid employee and ranked twelfth among all regions in the Philippines.

CAR ranks 6th in revenue per peso expense

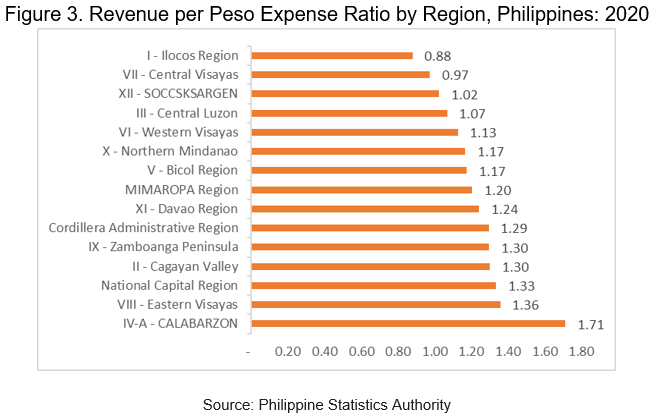

Establishments in CAR had 1.29 revenue per peso expense ratio and ranked sixth among all regions in the Philippines.

(SGD)

VILLAFE P. ALIBUYOG

Regional Director

__________________________________________

TECHNICAL NOTES

An establishment is defined as an economic unit under a single ownership or control which engages in one or predominantly one kind of economic activity at a single fixed location.

An establishment is categorized by its economic organization, legal organization, industrial classification, employment size, and geographic location.

Size of an establishment is determined by its total employment as of the time of visit during the latest Updating of the List of Establishments.

Total Employment (TE) refers to the total number of persons who work in or for the establishment. This includes paid employees, working owners, unpaid workers, and all employees who work full-time or part-time including seasonal workers. Also included are persons on short-term leave such as those on sick, vacation or annual leaves, and on strike.

Compensation is the sum of salaries and wages, separation/retirement/terminal pay, gratuities, and payments made by the employer on behalf of the employees such as contribution to SSS/GSIS, ECC, PhilHealth, Pag-ibig, etc.

Expense is the cost incurred by the establishment during the year whether paid or payable. This is treated on a consumed basis. Valuation is at purchaser price including taxes and other charges, net of rebates, returns, and allowances. Goods and services received by the establishment from other establishments of the same enterprise are valued as though purchased.

Paid employees are all persons working in the establishment and receiving pay, as well as those working away from the establishment paid by and under the control of the establishment. Included are all employees on sick leave, paid vacation, or holiday. Excluded are consultants, home workers, receiving pure commissions only, and workers on indefinite leave.

Revenue is the cash received and receivables for goods/products and by-products sold and services rendered. Valuation is at producer prices (ex-establishment) net of discounts and allowances, including duties and taxes but excluding subsidies.