The Census of Philippine Business and Industry (CPBI) is one of the designated statistical activities of the Philippine Statistics Authority (PSA), undertaken every five years, which aims to collect and generate information on the levels, structure, performance and trends of economic activities of the formal sector of the economy. The results of the CPBI serve as benchmark information in the measurement of national and regional economic growth. The 2018 CPBI is the 16th of the series of economic censuses in the country.

This Special Release explores the performance of the Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles Establishments sector in terms of the number of establishments engaged in Wholesale and Retail Trade activities, employment generated (as of 15 November 2018), total income and expense, value added, subsidies granted by the government, and sales from e-commerce transactions.

Wholesale and retail trade sector (WRT) grows by 43.6% in 2018

- In 2018, a total of 137,674 establishments were engaged in wholesale and retail trade; repair of motor vehicles and motorcycles. This was a 43.6% increase from the 95,850 recorded establishments nationwide in 2012.

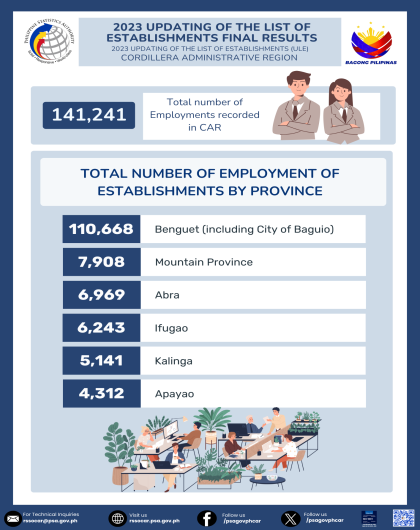

- Among industry groups, retail sale of other goods in specialized stores with 39,585 establishments accounted for the largest share (28.8%). Retail sale of other household equipment in specialized stores and retail sale in nonspecialized stores followed with 17,389 and 13,478 establishments, respectively. The non-specialized wholesale trade had the least number of establishments in wholesale and retail trade with 93 establishments.

-

Among the establishments engaged in wholesale and retail trade (WRT) in the Philippines, National Capital Region (NCR) had the most share with 15.5% of the total WRT establishments, followed by CALABARZON and Central Visayas with 9.1% and 8.5% shares, respectively. On the other hand, the ARMM had the least number of establishments engaged in wholesale and retail trade with 1.4% share of the total WRT industry.

-

Workers engaged in wholesale and retail trade industry increased by 42.6% from 989,499 in 2012 to 1,410,967 employees in 2018. Retail sale of other goods in specialized stores generated the most employment accounting for 19.6% (276,442 workers) of the total industry employment.

Figure 1. Top Wholesale and Retail Trade Industries and Regions by Number

of Establishments and Total Employment, Philippines: 2018

- Retail sale in non-specialized stores with 245,299 employees (17.4%), and retail sale of other household equipment in specialized stores with 174,848 employees (12.4%) ranked second and third, respectively. On the other hand, non-specialized wholesale trade had the least contribution to WRT employment with 1,539 employees or 0.1% share.

-

National Capital Region had the biggest number of WRT workers with 382,716 or 27.1% share of the total employment in the industry. This was followed by CALABARZON and Central Visayas with 10.4% and 8.8% shares. In addition to the employees in the industry, a total of 107,658 workers on sub-contract agreement or under manpower agencies contractors were also engaged.

Compensation expenses of wholesale and retail trade sector at PhP290.7 billion

- The wholesale and retail trade sector spent a total of PhP290.7 billion to compensate its 1,372,734 employees in 2018. From this, it can be said that a worker from the wholesale and retail trade (WRT) industry earned an average annual income of PhP211,764.

- Establishments engaged in retail sale of other goods in specialized stores spent the most in paying its workers with PhP65.8 billion. This was followed by retail sale in nonspecialized stores (PhP38.5 billion), wholesale of household goods (PhP32.8 billion), and retail sale of other household equipment in specialized stores (PhP28.3 billion).

Figure 2. Top Wholesale and Retail

Trade Industries by Total Compensation Expenses, Philippines: 2018

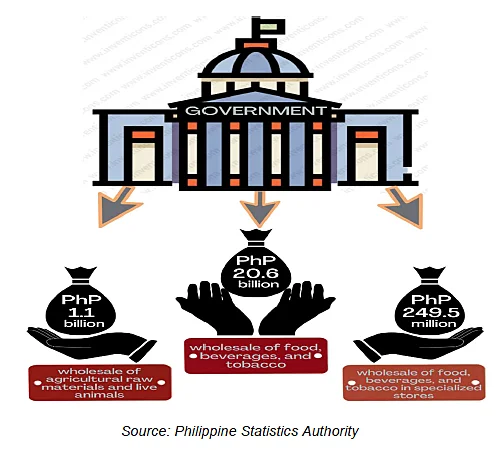

- At the regional level, National Capital Region (NCR) spent the most for compensation amounting to PhP121.8 billion, followed by CALABARZON with PhP35.6 billion. In CAR, a total of PhP4.2 billion was disbursed to the wholesale and retail trade industry employees in 2018. This led to a per capita average annual compensation of PhP153,479.

Income of wholesale and retail trade establishments up by 56.0%

- Wholesale and retail trade (WRT) industries generated a total revenue of PhP8.6 trillion in 2018, reflecting a 56.0% increase from the PhP3.8 trillion revenue of the sector in 2012.

- Majority of the total national income of WRT establishments were from NCR with PhP3.1 trillion or 36.2% share. Entities from CALABARZON generated the second-most revenue in the country with PhP1.2 trillion. Meanwhile, ARMM had the least contribution to WR income with PhP 8.9 billion or a 0.1% share.

- Retail sale of other goods in specialized stores contributed the highest income to the total national income with PhP1.4 trillion. Income from retail sale in nonspecialized stores came next with about PhP1.4 trillion. The top industry income-earners were also the main contributors to the sector’s expenses: retail sale in non-specialized stores spent PhP1.29 trillion (16.1%) and retail sale of other goods in specialized stores with PhP1.25 trillion (15.7%).

Figure 3. Top Wholesale and Retail Trade Industries by Income per Expense,

Annual Income and Expense, Philippines: 2018

- Expenditures of wholesale and retail trade entities reached PhP8.0 trillion in 2018, a 55.0% increase from 2012’s costs of PhP3.6 trillion. The amount spent for the compensation of employees only comprised 3.6% of the sector’s total spending.

-

The top region income-earners in wholesale and retail trade industry were also the main contributors to the sector’s expenses: NCR spent PhP2.9 trillion (36.4%) and CALABARZON with PhP1.2 trillion (15.1%). Meanwhile, the ARMM had the least contribution to WRT expense with PhP5.9 billion (0.1%).

-

Seven of the industry groups in wholesale and retail trade exceeded the 1.07 national revenue per expense ratio. These industries were: Wholesale on a fee or contract basis (1.21); maintenance and repair of motor vehicles (1.20); retail sale of other goods in specialized store (1.12); other specialized wholesale (1.10); wholesale of agricultural raw materials and live animals (1.09); wholesale of household goods (1.08); and retail sale of cultural and recreation goods in specialized stores (1.08).

Cordillera Administrative Region revenue per expense ratio at 1.3, higher than the national level

- In CAR, retail sale in nonspecialized stores, retail sale of other household equipment in specialized stores, and retail sale of automotive fuel in specialized stores recorded the most revenues in 2018 with PhP21.2 billion, Php14.0 billion, and PhP9.6 billion, respectively.

- Expenditures of wholesale and retail trade in CAR reached PhP81.9 billion in 2018. The top industry income-earners in CAR were also the main contributors to the region’s expenses: retail sale in nonspecialized stores spent PhP20.6 billion (25.1%), retail sale of other household equipment in specialized stores with PhP13.2 billion (16.2%), and retail sale of automotive fuel in specialized stores with PhP9.04 billion (11.0%).

Figure 4. Top Wholesale and Retail Trade

Industries by Income per Expense, Annual Income and Expense, CAR:2018

Value added of WRT industries increases by 63.6% in 2018

- Value added generated by all wholesale and retail trade establishments in 2018 reached about PhP999.0 billion, grew by 63.6% from PhP364.1 billion produced in 2012.

- Industry-wise, retail sale of other goods in specialized stores contributed the highest value added with PhP244.6 billion or 24.5% share to the total output of the sector. This was followed by retail sale in non-specialized stores with PhP128.5 billion (12.9%).

- Across regions, NCR registered the highest value added with PhP380.9 billion (38.1%), followed by Northern Mindanao and CALABARZON with PhP118.6 billion (11.9%) and PhP92.6 billion (9.3%), respectively. CAR establishments engaged in wholesale and retail trade reported a value-added total to PhP10.6 billion.

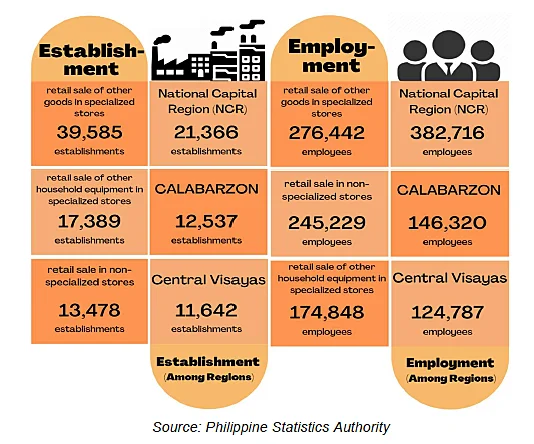

Subsidies receive by WRT industry from government increases by 63.7%

- The total subsidies received by the wholesale and retail trade sector amounted to PhP 22.0 billion in 2018. This was 63.7% higher than the PhP8.0 billion worth of subsidies granted by the government in 2012.

- Wholesale of food, beverages, and tobacco (PhP20.6 billion), wholesale of agricultural raw materials and live animals (PhP1.1 billion), and retail sale of food, beverages, and tobacco in specialized stores (PhP249.5 million) were the top industries in wholesale and retail trade that received subsidies from the government in 2018.

Figure 5. Subsidies Granted by the Government to Wholesale and Retail Trade

Industries, Philippines: 2018

WRT establishments earn PhP22.5 billion from e-commerce

- E-commerce transactions in wholesale and retail trade establishments generated sales amounting to PhP22.5 billion in 2018. This was a PhP20.5 billion increase from the PhP2.0 billion worth of goods and services sold by WRT businesses in 2012.

Figure 6. Top Wholesale and Retail Trade Industries by Sales from

E-commerce Transactions, Philippines: 2018

- Across industries, retail sale of other goods in specialized stores accounted for 68% (PhP15.2 billion) of the total sales from e-commerce transactions of the sector. Wholesale of household goods (PhP3.3 billion), and retail sale of other household equipment in specialized stores (PhP1.9 billion).