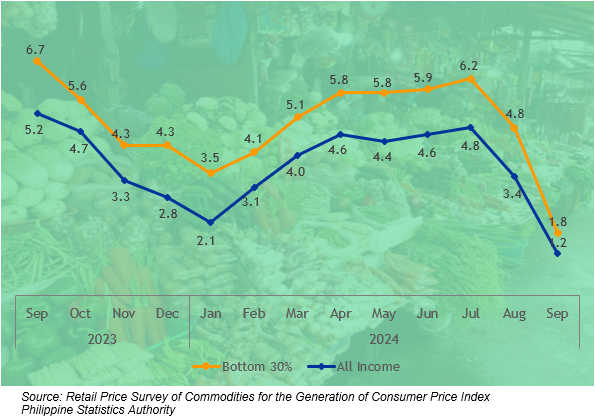

Figure 1: Inflation Rate for the Bottom 30% Income Households in CAR,

All Items: September 2023 - September 2024

In Percent (2018=100)

1. Cordillera Administrative Region (CAR)

In September 2024, the inflation rate for the bottom 30% income households in the Cordillera Administrative Region (CAR) further decelerated to 1.8%, from 4.8% in August 2024. This brings the bottom 30% income households regional average inflation rate from January to September 2024 to 4.8%. In September 2023, the inflation rate was at 6.7% (Table 1 and Figure 1).

1.1 Main Drivers to the Downward Trend of Inflation

The downtrend was primarily driven by lower price growth in the Food and Non-Alcoholic Beverages with 2.2%, from 7.0% in August 2024. This commodity group contributed 82.3% share to the deceleration of the bottom 30% income households in the region. Additionally, Housing, Water, Electricity, Gas, and Other Fuels with -0.8% from 1.5% in the previous month, contributed 15.0% share (Table 1, Table 2 and Figure 1).

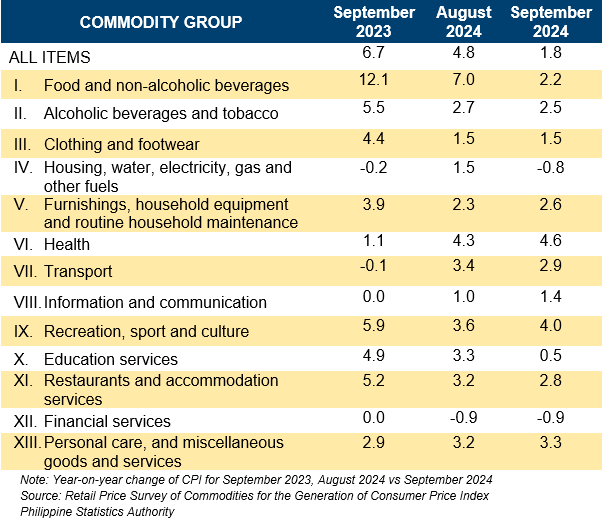

Table 1: Year-on-Year Inflation Rates for Bottom 30% Income Households

by Commodity Group in CAR, All Items: September 2023, August-September 2024

In Percent (2018=100)

1.2 Inflation Trends of Commodity Groups for the Bottom 30% Income Households

Lower annual growth rates were registered in the following commodity groups during the month:

a. Education Services, 0.5% from 3.3%;

b. Transport, 2.9% from 3.4%;

c. Restaurants and Accommodation Services, 2.8% from 3.2%; and

d. Alcoholic Beverages and Tobacco, 2.5% from 2.7%.

Conversely, higher annual increases were noted in the indices of the following commodity groups during the month:

a. Furnishings, Household Equipment and Routine Household Maintenance, 2.6% from 2.3%;

b. Health, 4.6% from 4.3%;

c. Information and Communication, 1.4% from 1.0%;

d. Recreation, Sport and Culture, 4.0% from 3.6%; and

e. Personal Care, and Miscellaneous Goods and Services, 3.3% from 3.2%.

The rates for Clothing and Footwear and Financial Services remained unchanged at 1.5% and -0.9%, respectively (Table 1).

1.3 Top Three Contributors to Inflation for the Bottom 30% Income Households

The following commodity groups were the top three contributors to the overall inflation rate for the bottom 30% income households in September 2024:

a. Food and Non-Alcoholic Beverages: 65.3% share, contributing 1.1 percentage points

b. Transport: 10.4% share, contributing 0.1 percentage points

c. Personal Care and Miscellaneous Goods and Services: 9.7% share, contributing 0.1 percentage points

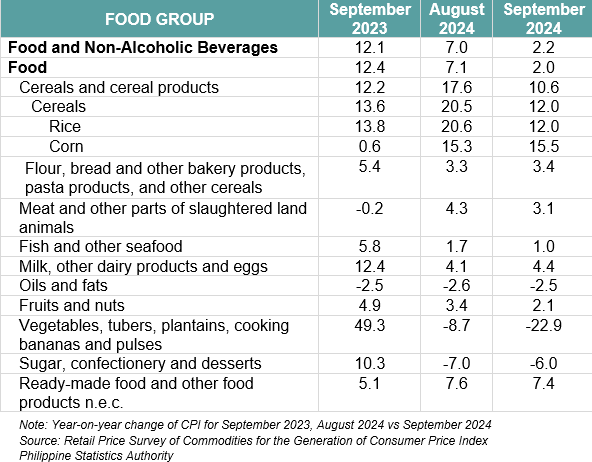

2. Food Inflation in CAR

Food inflation for the bottom 30% of income households in the region decelerated to 2.0% in September 2024, from 7.1% in August 2024. In September 2023, food inflation was recorded at 12.4% (Table 2).

1.1 Main Drivers of the Downward Trend in Food Inflation

The decline in food inflation was primarily driven by a slower increase in Rice prices, which recorded an inflation rate of 12.0%, from 20.6% in August 2024. This food group contributed 65.4% to the overall deceleration in food inflation for the bottom 30% of income households in the region.

Additionally, the food group of Vegetables, Tubers, Plantains, Cooking Bananas, and Pulses registered an inflation rate of -22.9%, down from -8.7% the previous month, contributing 28.9% to the downward trend (see Table 1, Table 2, and Figure 1).

Moreover, lower annual growth rates in September 2024 were observed for the following food items:

a. Meat and Other Parts of Slaughtered Land Animals, 3.1% from 4.3%;

b. Fish and Other Seafood, 1.0% from 1.7%;

c. Fruits and Nuts, 2.1% from 3.4%; and

d. Ready-Made Food and Other Food Products (not elsewhere classified), 7.4% from 7.6%.

Table 2: Year-on-Year Inflation Rates for Bottom 30% Income Households

by Food Group in CAR, All Items: September 2023, August 2024-September 2024

In Percent (2018=100)

Conversely, the following commodity groups experienced an upward trend during the month:

a. Corn, 15.5% from 15.3%;

b. Flour, Bread and Other Bakery Products, Pasta Products, and Other Cereals, 3.4% from 3.3%;

c. Milk, Other Dairy Products and Eggs, 4.4% from 4.1%;

d. Oils and Fats, -2.5% from -2.6%; and

e. Sugar, Confectionery and Desserts, -6.0% from -7.0%.

2.2 Main Contributors to Cordillera Food Inflation

Food inflation contributed 58.6% or 1.0 percentage point to the overall inflation rate of 1.8% in the region for September 2024 among the bottom 30% of income households. The top three food groups contributing to the 2.0% food inflation during the month were:

a. Rice: 134.3% share, contributing 2.6 percentage points;

b. Meat and Other Parts of Slaughtered Land Animals: 11.3% share, contributing 0.2 percentage points; and

c. Ready-Made Food and Other Food Products: 6.9% share, contributing 0.1 percentage points.

In contrast, the category of Vegetables, Tubers, Plantains, Cooking Bananas and Pulses recorded an inflation rate of -22.9%, contributing -66.9% share or -1.3 percentage points to overall food inflation.

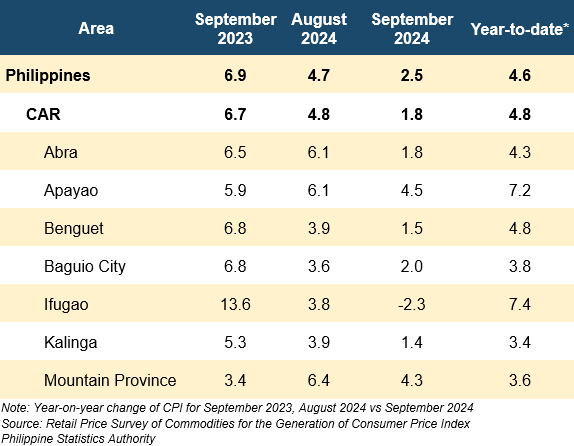

Table 3: Year-on-Year Inflation Rates for Bottom 30% Income Households

by Province/City in CAR, All Items: September 2023, August-September 2024

In Percent (2018=100)

3. Provinces/ Highly Urbanized City (HUC) in CAR

In September 2024, inflation rates for the bottom 30% of income households declined across all provinces and the City of Baguio in the Cordillera region. Among these areas, Apayao recorded the highest inflation rate at 4.5%, while Ifugao reported the lowest rate in CAR at -2.3% (Table 3).

________________________________________________________________

Note:

CPI and inflation rates by province and selected city are posted on the PSA website (http://openstat.psa.gov.ph).

(SGD)

VILLAFE P. ALIBUYOG

Regional Director

Designation Initials Date

SOCD, CSS AFRB 09 October 2024

SOCD, IO RJPA

SOCD, AS NLP 08 October 2024

Technical Notes

Concepts and Definitions of Terms

Base Period a reference period, usually a year, at which the index number is set to 100. It is the reference point of the index number series.

Consumer Price Index (CPI) is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by an average Filipino household. It shows how much on average, prices of goods and services have increased or decreased from a particular reference period known as base year.

Inflation Rate refers to the annual rate of change or the year-on-year change of the CPI expressed in percent. Inflation is interpreted in terms of the declining purchasing power of money.

Market Basket for CPI purposes, market basket is a term used to refer to a sample of goods and services that are commonly purchased and bought by an average Filipino household.

Philippine Classification of Individual Consumption According to Purpose (PCOICOP) A detailed classification of individual consumption expenditures on goods and services incurred by the three (household, general government, non-profit institutions serving households) of the five institutional sectors (non-financial corporations, financial corporations) of the 1993 and 2008 Systems of National Accounts (SNA). The PCOICOP was patterned after the United Nations COICOP.

Purchasing Power of the Peso (PPP) shows how much the peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

Weight is a value attached to a commodity or group of commodities to indicate the relative importance of that commodity or group of commodities in the market basket.