This Special Release explores the performance of the Financial and Insurance Activities (FIA) sector in terms of the number of establishments engaged in IAC activities, employment generated (as of 15 November 2018), total income and expense, value added, subsidies granted by the government, and sales from e-commerce transactions.

- The results of the 2018 Census of Philippine Business and Industry (CPBI) showed that a total of 41,657 establishments in the formal sector of the economy were engaged in financial and insurance activities. This was 498.4 percent higher than the 6,961 recorded establishments in 2012.

- Other financial service activities, except insurance and pension funding activities such as financial leasing, other credit granting, and pawnshop operations accounted for 62.2 percent of the financial and insurance establishments in the country. This was followed by monetary intermediation and activities auxiliary to financial service, except insurance and pension funding such as furnishing of physical or electronic market places for the purpose of facilitating the buying and selling of stocks with 22.2 percent and 7.9 percent shares, respectively.

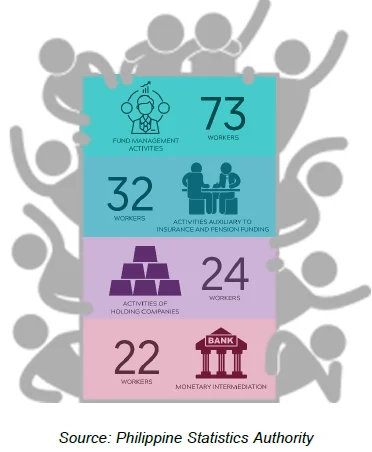

- Workers engaged in financial and insurance activities (FIA) increased by 50.4 percent from 308,630 in 2012 to 464,176 employees in 2018. Monetary intermediation generated the most employment accounting for 43.0 percent (199,505 workers) of the total national employment. Other financial service activities, except insurance and pension funding activities had the second-most employees with 186,827 workers or 40.2 percent share. On the other hand, pension funding had the least contribution to national employment with a minimal 0.02 percent share.

Figure 1. Top Financial and Insurance Activities (FIA) Industries by Number of Establishments and Total Employment, Philippines: 2018

- One in seven financial and insurance establishments were located in the National Capital Region (NCR) while Central Luzon and Western Visayas had 8.6 and 7.3 percent shares, respectively. Meanwhile, Cordillera Administrative Region (CAR) recorded a 2.6 percent share to the total number of financial and insurance establishments.

Compensation expenses of financial and insurance reach 200 billion mark

- The financial and insurance sector spent a total of PhP 293.4 billion to compensate its 460,094 paid employees in 2018. This was a 97.6 percent increase from the PhP 148.5 billion worth of compensation expended to 305,964 workers engaged in financial and insurance activities in 2012.

-

Firms engaged in monetary intermediation spent the most in the financial and insurance sector in terms of compensation to itsemployees. The industry disbursed PhP 155.3 billion to its workers in 2018. This was followed by establishments involved with other financial service activities, except insurance and pension funding activities with PhP 68.1 billion compensation and insurance with PhP 29.1 billion.

- Establishments in CAR disbursed a total of PhP 3.2 billion to the financial and insurance employees in 2018. This led to an average annual compensation of PhP 434,228 per employee. Financial and insurance firms in NCR spent the most for the compensation of its employees at PhP 176.5 billion.

Income of financial and insurance establishments exceeds expenses by 38%

- Financial and insurance industries generated a total revenue of PhP 2.3 trillion in 2018, reflecting a 103.0 percent increase from the PhP 1.1 trillion-revenue of the sector in 2012.

- Majority (PhP 1.6 trillion) of the total national income of financial and insurance establishments were from NCR. Entities from Central Visayas generated the second highest revenue in the country with PhP 75.0 trillion, followed by Northern Mindanao with PhP 73.3 trillion and CALABARZON with PhP 71.3 trillion.

- Monetary intermediation industry contributed the highest income to the total national income with 39.5 percent share or PhP 904.5 billion. Income from insurance came next with PhP 533.9 billion (23.2 percent) and other financial service activities, except insurance and pension funding activities with PhP 384.4 billion (16.8 percent).

-

Expenditures of financial and insurance entities reached PhP 1.6 trillion in 2018, a 113.6 percent increase from 2012’s costs of PhP 775.4 billion. The amount spent for the compensation of employees only comprised 17.7 percent of the sector’s total spending.

-

The top industry income-earners in financial and insurance establishments were also the main contributors to the sector’s expenses: monetary intermediation spent PhP 695.1 billion (42.0 percent) and insurance with PhP 444.3 billion (26.8 percent).

-

Financial and insurance businesses situated in NCR (PhP 1.1 trillion or 66.6 percent), Northern Mindanao (PhP 62.2 billion or 3.8 percent), and SOCCSKSARGEN (PhP 56.1 billion or 3.4 percent) were the top spenders in 2018.

- In CAR, monetary intermediation, other financial service activities, except insurance and pension funding activities, and insurance recorded the most revenues in 2018 with PhP 11.1 billion, PhP 5.6 billion, and PhP 1.5 billion earnings, respectively. On the other hand, industries with the highest expenditures in the region were monetary intermediation (PhP 8.4 billion), other financial service activities, except insurance and pension funding activities (PhP 2.7 billion), and insurance (PhP 1.3 billion).

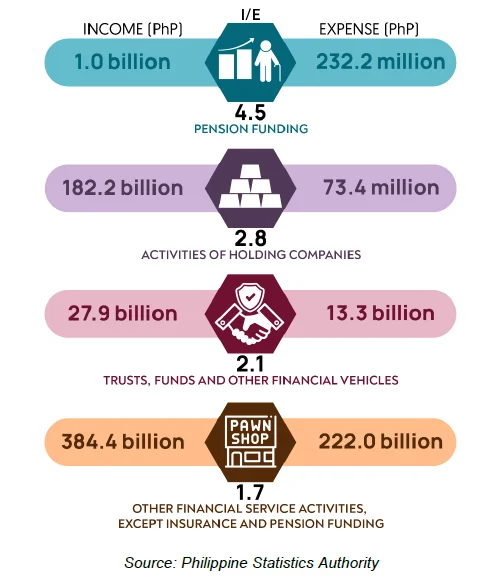

- Pension funding had the greatest gain with an income per expense ratio of 4.5. This was followed by activities of holding companies and trusts, funds and other financial vehicles with 2.8 and 2.1 income per expense ratios, respectively.

- On the other hand, insurance and activities auxiliary to insurance and pension funding incurred the least income per expense ratio of 1.2 in 2018. Monetary intermediation had the second least I/E ratio of 1.3.

- Among all regions, only Autonomous Region in Muslim Mindanao (1.8), Eastern Visayas (1.7), Caraga (1.6), and MIMAROPA (1.5) had income per expense rates higher than the national rate (1.4). Meanwhile, NCR, CAR, Ilocos Region, Central Visayas, and Zamboanga Peninsula regions’ income per expense were at par with the national figure.

2018 value added of FIA industries surpasses PhP 1 trillion

- Value added realized by financial and insurance establishments in 2018 was PhP 1.0 trillion. This figure increased by more than 75 percent relative to the value added recorded by the sector in 2012.

- Industry-wise, monetary intermediation registered the highest value added with PhP 426.5 billion or 40.8 percent contribution to the total output of the FIA sector. This was followed by other financial service activities, except insurance and pension funding activities with PhP 252.6 billion (24.2 percent) and activities of holding companies with PhP 156.9 billion (15.0 percent). Conversely, pension funding contributed the least to the total sector production with PhP 968.0 million which translates to 0.09 percent of the total value added of the financial and insurance activities sector.

- Across regions, NCR (PhP 708.0 billion), Central Visayas (PhP 39.1 billion), and Davao Region (PhP 35.2 billion) had the most value added in 2018. CAR establishments engaged in financial and insurance activities reported PhP 10.8 billion.

Subsidies in 2018 almost double the 2012 grants

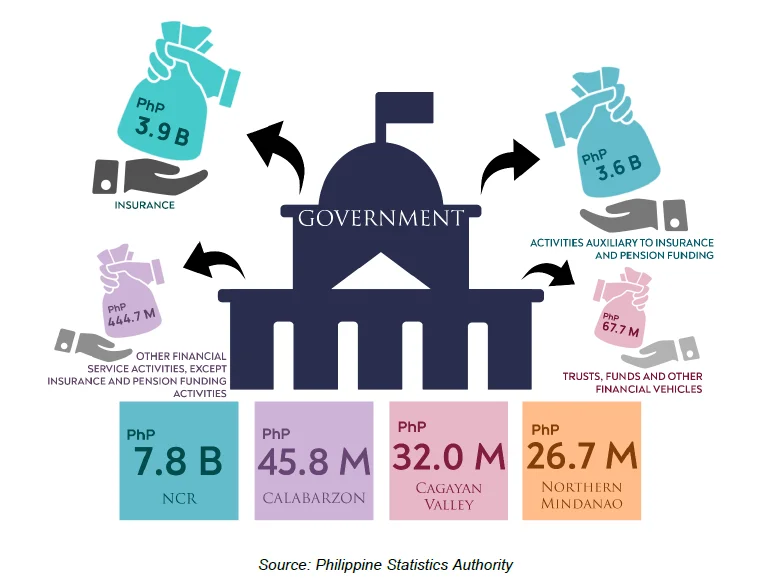

Figure 4. Subsidies Granted by the Government Financial and Insurance Activities Industries and Regions, Philippines: 2018

- The total subsidies received by the financial and insurance activities sector amounted to PhP 7.9 billion in 2018. This was 98.1 percent higher than the PhP 4.0 billion worth of subsidies granted by the government in 2012.

- Insurance (PhP 3.9 billion), activities auxiliary to insurance and pension funding (PhP 3.6 billion), other financial service activities, except insurance and pension funding activities (PhP 444.7 million), and trusts, funds and other financial vehicles (PhP 67.7 million) comprise the industries that received subsidies from the government in 2018.

- Among all regions, NCR (PhP 7.8 billion), CALABARZON (PhP 45.8 million), Cagayan Valley (PhP 32.0 million), Northern Mindanao (PhP 26.7 million),Caraga (PhP 21.0 million), Bicol Region (PhP 15.3 million), MIMAROPA (PhP 6.2 million), Central Luzon (PhP 2.7 million), SOCCSKSARGEN (PhP 441 thousand), and Davao Region (PhP 26 thousand) were the only recipients of government grants.

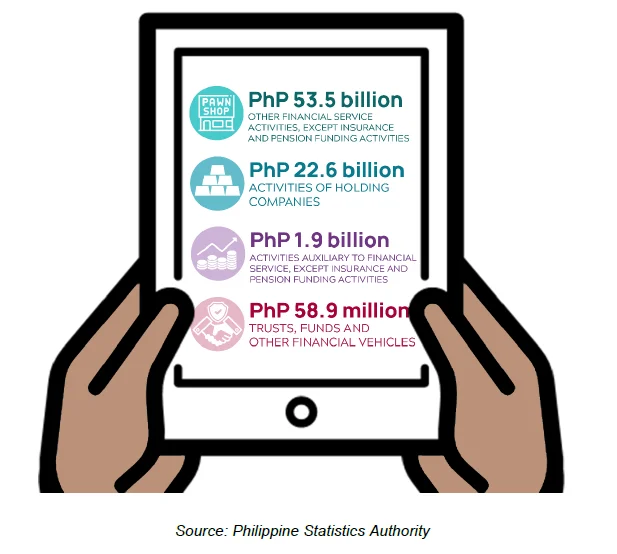

FIA establishments gain more than PhP 75 billion from e-commerce

- E-commerce transactions in financial and insurance activities establishments generated sales amounting to PhP 78.1 billion in 2018. This was a huge increase from the PhP 1.6 billion worth of goods and services sold online by FIA businesses in 2012.

- Across industries, other financial service activities, except insurance and pension funding activities accounted for 68.5 percent (PhP 53.5 billion) of the total sales from e-commerce transactions of the sector. Activities of holding activities (PhP 22.6 billion), activities auxiliary to financial service, except insurance and pension funding (PhP 1.9 billion), and trusts, funds and other financial vehicles (PhP 58.9 million) comprise the remaining 31.5 percent of the total sales from e-commerce transactions.