The Annual Survey of Philippine Business and Industry (ASPBI), one of the designated statistical activities of the Philippine Statistics Authority (PSA), generated essential statistics for economic planning and analysis. It is specifically designed to collect and generate information on the levels, structure, performance, and trends of economic activities of the formal sector of the country’s economy. The 2020 ASPBI is the 48th in the series of annual surveys of establishments in the country. It was conducted nationwide in April 2021 with 2020 as reference period. In this round of the ASPBI, the 2020 Survey of Tourism Establishments in the Philippines (STEP) is a rider to this survey. This Special Release discusses the performance of the Financial and Insurance Activities Sector which includes monetary intermediation, activities of holding companies, trusts, funds, and other financial vehicles, other financial service activities, except insurance and pension funding activities, insurance, reinsurance, pension funding, activities auxiliary to financial service, except insurance and pension funding, activities auxiliary to insurance and pension funding, and fund management activities. |

Financial and insurance sector contracts by six percent

The results of the 2020 Annual Survey of Philippine Business and Industry (ASPBI) showed that a total of 36,576 establishments in the formal sector were engaged in financial and insurance activities. This was 5.7% lower than the 38,804 recorded establishments in 2019.

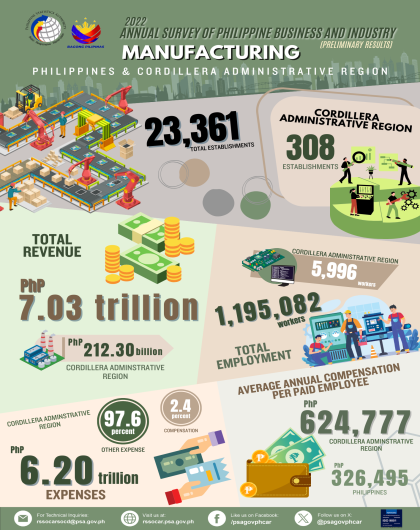

Among the industries comprising the sector, other financial service activities, except insurance and pension funding activities, which include activities such as financial leasing, credit card activities, lending company operations, pawnshop operations, credit cooperative activities, and foreign exchange dealing/money changing, recorded the highest number of establishments with 22,169 or 60.6% of the sector. This was followed by monetary intermediation with 9,042 establishments (24.7%) and activities auxiliary to financial service, except insurance and pension funding with 2,334 establishments (6.4%).

Figure 1. Top Financial and Insurance Activities Industries by Number

of Establishments, Philippines: 2020

Region-wise, most of the establishments engaged in financial and insurance activities were located in the National Capital Region (NCR) with 7,468 establishments. Further, nearby regions CALABARZON and Central Luzon had 11.9% and 10.2% shares, respectively. Meanwhile, Cordillera Administrative Region (CAR) recorded 646 financial and insurance establishments following the Autonomous Region in Muslim Mindanao (ARMM) with 0.5% share to the total number of sector establishments – the least among all regions.

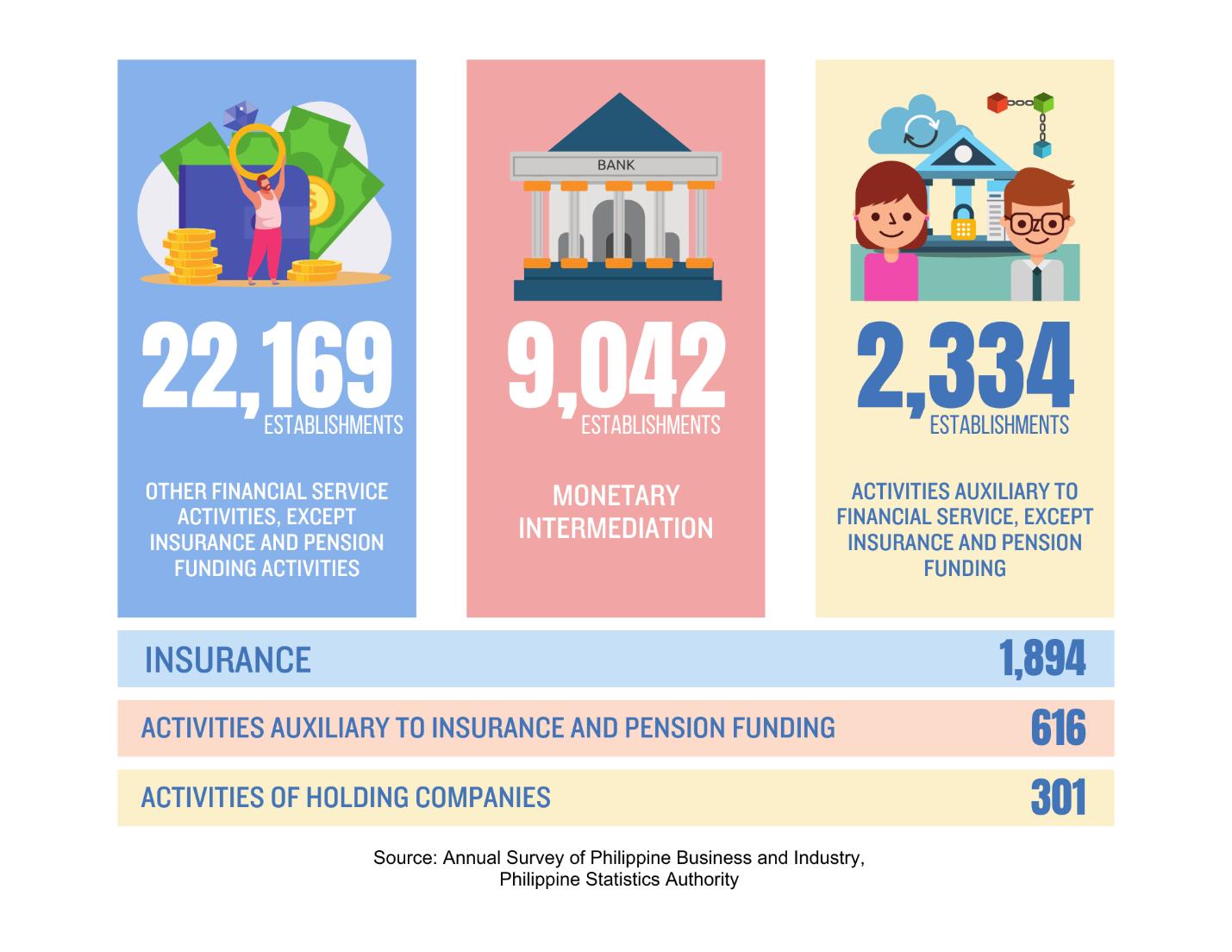

Eighty-five percent of sector employment come from monetary intermediation and other financial service activities, except insurance and pension funding

In 2020, a total of 388,043 workers were employed in the financial and insurance activities sector in the Philippines – a 40.5% decline from the 652,178 establishments recorded in the previous year. Majority of this workforce were paid employees while the remaining 0.3% were working owners and unpaid workers.

Among industry groups, monetary intermediation generated the most employment with 44.8% of the total national sector employment or 173,753 workers. Other financial service activities, except insurance and pension funding activities followed with 157,441 workers or 40.6% share. These two industries combine for 85.3% of the total financial and insurance activities employment in the country. On the other hand, reinsurance had the least contribution to the employment generated by the sector in the Philippines with 0.02%.

Figure 2. Percentage Distribution of Employment in the Financial and Insurance

Activities Sector, by Industry Group, Philippines: 2020

By region, NCR had the highest employment with 171,403 workers, almost half of the total sector employment in the country. CALABARZON followed with 30,453 workers, Western Visayas with 23,609 workers, Central Luzon with 23,192 workers, and Central Visayas with 22,306 workers. These five regions comprised more than two-thirds of the total employment generated by the financial and insurance activities. On the other hand, there were 4,625 workers employed in the sector in CAR.

In terms of ratio, the financial and insurance activities sector posted an average employment of 11 workers per establishment. This was 36.9% lower than that of the previous year’s average employment.

Fund management activities, which include management of mutual, other investment, and pension funds, posted the highest average employment with 60 workers per establishment among all financial and insurance industries. Among the regions, NCR recorded the highest average employment with 23 workers per establishment. Moreover, Bicol Region and Northern Mindanao both had 11 workers per financial and insurance establishment. CAR financial and insurance businesses were composed of 7 workers, on the average.

Income of financial and insurance activities exceeds expenses by more than 500 billion

Establishments engaged in financial and insurance activities generated a total revenue of PhP2.0 trillion in 2020, which was 27.8% lower than the recorded total revenue in 2019 of PhP2.8 trillion.

Figure 3. Top Financial and Insurance Industries by Annual Revenue and Expense,

Philippines: 2020

(in Philippine Pesos)

More than half of the total sector income was contributed by establishments engaged in monetary intermediation with PhP1.0 trillion. Further, reflecting the national trend, the income generated by monetary intermediation establishments declined by 22.6%. The second top-earners were insurance companies with PhP324.6 billion (16.3%). Other financial service activities, except insurance and pension funding activities followed and accounted for 11.5% (PhP 324.6 billion) of the total revenue of the sector. Meanwhile, establishments related to reinsurance contributed less than a percent to the income of financial and insurance institutions in the country with PhP235.0 billion.

Across regions, financial and insurance establishments situated in NCR generated the most income accounting for more than three-fourths of the total sector revenue with PhP1.5 trillion. This was followed by neighboring regions CALABARZON and Central Luzon with PhP88.5 billion and PhP86.2 billion revenues, respectively. On the other hand, the regions with the least contributions to the income of the financial and insurance sector include ARMM with PhP382.9 million, Caraga with PhP 6.5 billion, and MIMAROPA Region with PhP9.9 billion. Together, these three regions accounted for less than a percent of the total income of the sector nationwide. Meanwhile, CAR financial and insurance establishments generated PhP12.3 billion in 2020.

In terms of expenditure, financial and insurance entities spent PhP1.5 trillion on compensation and other expenses in 2020, a 24.1% decline from the previous year’s costs of PhP2.0 trillion. In addition, the amount spent for the compensation of employees made up only 16.9% of the sector’s total spending, lower than the amount released by institutions for the wages of their workers in 2019.

The industry top income-earners in financial and insurance activities were also the main contributors to the sector’s expenses – monetary intermediation establishments spent PhP839.6 billion (56.5%); insurance companies released PhP251.2 billion (16.9%); and other financial services activities, except insurance and pension funding activities expended PhP171.7 billion (11.5%). Businesses located in NCR (PhP1.1 trillion), CALABARZON (PhP70.1 billion), and Central Luzon (PhP68.0 billion) were the top spenders in 2020.

Activities of holding companies' industry group generate the highest revenue per expense ratio

By revenue per expense ratio, financial and insurance activities posted a decrease of 4.8% from a 1.41 ratio in 2019 to a 1.34 ratio in 2020. This means that for every peso spent in 2020, the financial and insurance activities industries earned PhP 1.34 of income.

Activities of holding companies, which include units that hold the assets of a group of subsidiary corporations and whose principal activity is owning the group, recorded the highest revenue per expense ratio of 2.50, followed by pension funding with a revenue per expense ratio of 1.87, and other financial services activities, except insurance and pension funding activities with a 1.34 ratio.

Six regions recorded income per expense ratios that were higher than the national ratio (1.34). These were: Cagayan Valley with 1.65; ARMM with 1.47; Western Visayas with 1.38; NCR and Central Visayas both with 1.37; and Northern Mindanao with 1.35. Meanwhile, CAR establishments posted a revenue per expense ratio of 1.18.

Annual wage of paid employees increases by 15 percent, on average

The annual average earnings of paid employees in the financial and insurance sector increased by 14.9% from and an average annual compensation of PhP566,873 in 2019 to PhP651,431 in 2020.

Among industry groups, trusts, funds, and other financial vehicles recorded the highest average annual compensation per paid employee with PhP2.5 million. This was followed by activities of holding companies and monetary intermediation with PhP2.3 million and PhP858,756, respectively. On the other hand, fund management activities posted the lowest average annual compensation per paid worker with PhP201,062.

Among regions, NCR had the highest average annual compensation per paid employee with PhP994,123. CALABARZON followed with PhP553,444 and Northern Mindanao with PhP528,255. On the average, employees of financial and insurance establishments in CAR were paid PhP380,219 in 2020.

Subsidies granted increase by 20 percent

Figure 4. Subsidies Granted by the Government to Financial and Insurance Activities

Industries and Regions, Philippines: 2020

(in Philippine Pesos)

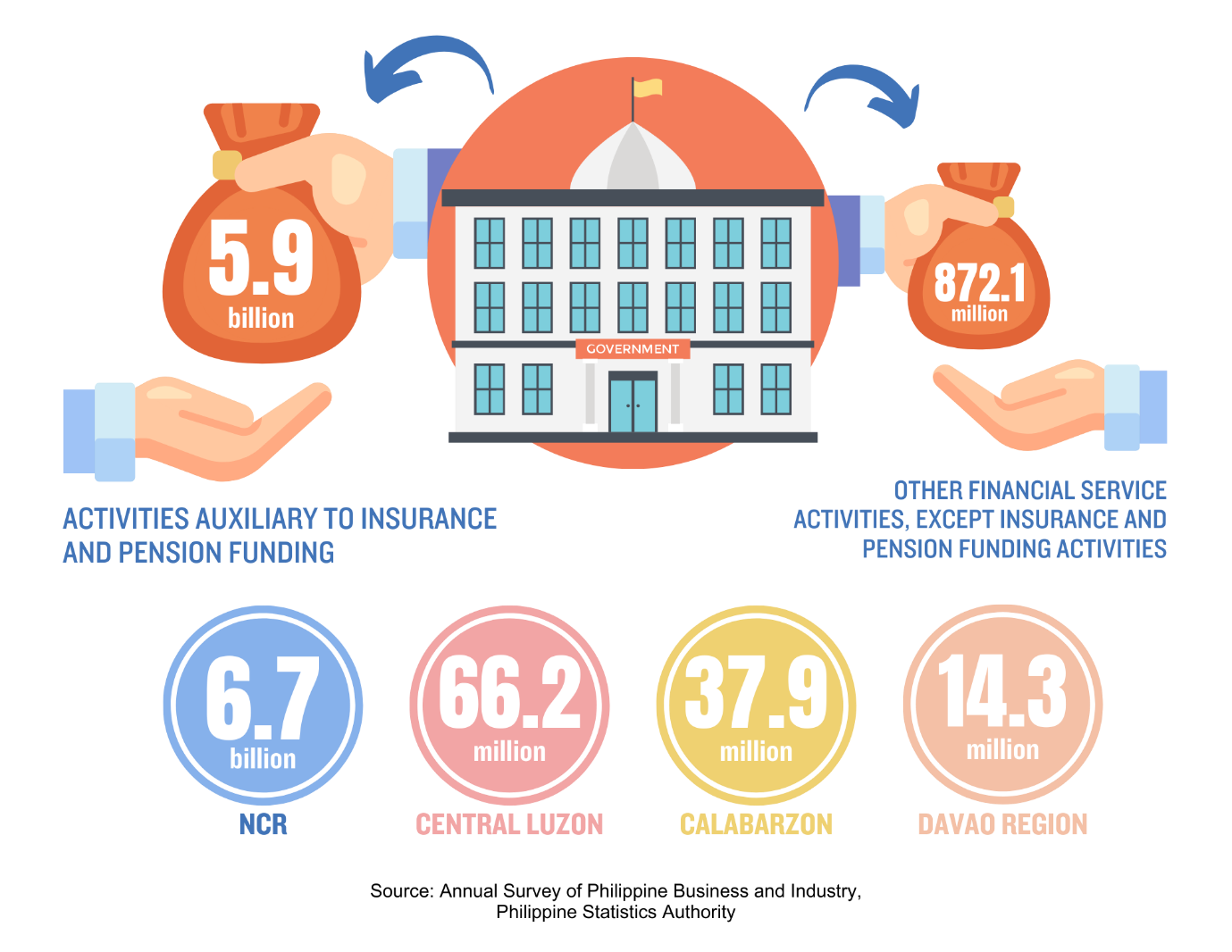

The total subsidies received by the financial and insurance activities sector amounted to PhP6.8 billion in 2020. This was 20.4% higher than the PhP5.7 billion worth of subsidies granted by the government in 2019. Five industries received subsidies from the government, namely: activities auxiliary to insurance and pension funding with PhP5.9 billion; other financial service activities, except insurance and pension funding activities with PhP872.1 million; monetary intermediation with PhP60.1 million; insurance with PhP2.2 million; and activities auxiliary to financial service, except insurance and pension funding with PhP1.4 million.

Across regions, NCR (PhP6.7 billion), Central Luzon (PhP66.2 million), CALABARZON (PhP37.9 million), and Davao Region (PhP14.3 million) received majority of the subsidies granted by the government to the financial and insurance activities sector.

(SGD)

VILLAFE P. ALIBUYOG

Regional Director

AFRBJ/RJPA/KAMC

Technical Notes

Establishment is an economic unit under a single ownership and control, i.e. under a single entity, engaged in one or predominantly one kind of economic activity at a single fixed location.

Economic activity is the establishment’s source of income. If the establishment is engaged in several activities, its main economic activity is that which earns the biggest income or revenue.

Total Employment refers to the total number of persons who work in or for the establishment. This includes paid employees, working owners, unpaid workers, and all employees who work full-time or part-time including seasonal workers. Also included are persons on short-term leave such as those on sick, vacation or annual leaves, and on strike.

Paid employees are all persons working in the establishment and receiving pay, as well as those working away from the establishment paid by and under the control of the establishment. Included are all employees on sick leave, paid vacation or holiday. Excluded are consultants, home workers, receiving pure commissions only, and workers on indefinite leave.

Compensation is the sum of salaries and wages, separation/retirement/terminal pay, gratuities and payments made by the employer in behalf of the employees such as contribution to SSS/GSIS, ECC, PhilHealth, Pag-ibig, etc.

Salaries and wages are payments in cash or in kind to all employees, prior to deductions for employee’s contributions to SSS/GSIS, withholding tax, etc. Included are total basic pay, overtime pay and other benefits.

Income or Revenue refers to cash received and receivables for goods/products and by-products sold and services rendered. Valuation is at producer prices (ex-establishment) net of discounts and allowances, including duties and taxes but excluding subsidies.

E-commerce refers to the selling of products or services over electronic systems such as Internet Protocol-based networks and other computer networks. Electronic data Interchange (EDI) network, or other online system. Excluded are orders received from telephone, facsimile and e-mails.

Expense refers to cost incurred by the establishment during the year whether paid or payable. This is treated on a consumed basis. Valuation is a purchaser price including taxes and other charges, net of rebates, returns and allowances. Goods and services received by the establishment from other establishments of the same enterprise are valued as though purchased.

Value added is gross output less intermediate input. Computation of gross output for financial and insurance activities sector varies per industry as presented below:

For PSIC K641, K649 is equal to the sum of net interest income (interest income – interest expense); value of industrial services done for others; value of non-industrial services done for others less rent income from land; service charges; dividend income; commission and fees earned; foreign exchange gains; other income; capital expenditures produced on own account.

For PSIC K651, K652, K6623 is equal to the sum of net premiums earned (insurance premium- insurance claims paid); value of industrial services done for others; value of non-industrial services done for others less rent income from land; dividend income; commission and fees earned; other income; capital expenditures produced on own account.

For PSIC 66130 is equal to the sum of foreign exchange gains; value of industrial services done for others; value of non-industrial services done for others less rent income from land; commission and fees earned; other income; capital expenditures produced on own account.

For PSIC K642 is equal to the sum of dividend income; value of industrial services done for others; value of non-industrial services done for other less rent income from land; commission and fees earned; other income; capital expenditures produced on own account.

For PSIC K643, K66210, K66220, K66290, K66300, K661 except K66130 is equal to the sum of commission and fees earned; value of non-industrial services done for others; other income; capital expenditures produced on own account.

Intermediate input is equal to the sum of the following expense items: materials and supplies purchased; fuels, lubricants, oils and greases purchased; electricity purchased, water purchased; industrial services done by others; non-industrial services done by others less rent expense for land; research and development expense; environmental protection expense; royalty fee; franchise fee; foreign exchange losses and other expense.

Gross addition to tangible fixed assets is equal to capital expenditures less sale of fixed assets, including land.

Change in inventories is equivalent to the value of inventories at the end of the year less the value of inventories at the beginning of the year.

Inventories refer to the stock of goods owned by and under the control of the establishment as of a fixed date, regardless of where the stocks are located. Valuation is at current replacement cost in purchaser prices. Replacement cost is the cost of an item of its present price rather than its original cost.

Subsidies are all special grants in the form of financial assistance or tax exemption or tax privilege given by the government to aid and develop an industry.